Structured Products: Accumulator and Accrual

image: Google

Product Features

Accumulative Option is a group of higher generation exotics that allows the investors to gradually build up their positions over time or an expected target.

There are 3 common variations across different asset classes. We have:

- The vanilla version simply called Accumulator

- A slightly more complicated version called Accrual usually in the form of Accrual Range

- A version named Target Redemption, which, just as its name suggests, focuses on accumulating and reaching a specific target. One such popular structure is called Target Redemption Forwards (TARF)

- For the underlying selection, the Accumulator can be traded in various assets from stocks to commodities; while Accrual and Target Redemption are mostly in FX

1. Accumulator (Accumulative Forward):

Accumulator is a time-accumulated structured product linked to the performance of an underlying asset with an upside knock-out barrier.

Investor agrees to buy a certain amount of stock/asset at a discounted fixed price (the Strike) over a regular intervals, e.g., daily or weekly, for a set of period of time

Usually last for a year or less, terminated early (“knock-out”) if Spot > Barrier

Buy once if up, buy twice if down - Let’s consider an accumulator of stocks. This contract obligates an investor to buy a preset amount of underlying stocks at the Strike price \(X\), if the closing stock price on a trading day is higher than \(X\). However, when the stock closes lower than \(X\), the investor has to buy twice the amount of stocks at \(X\).

- The Strike price \(X\) is set at a discount of the original spot price \(S_0\) (thus some call it “discounted stock”. On the other hand, the profit from an accumulator contract is capped by an knock-out barrier \(H\) which is set higher than \(S_0\).

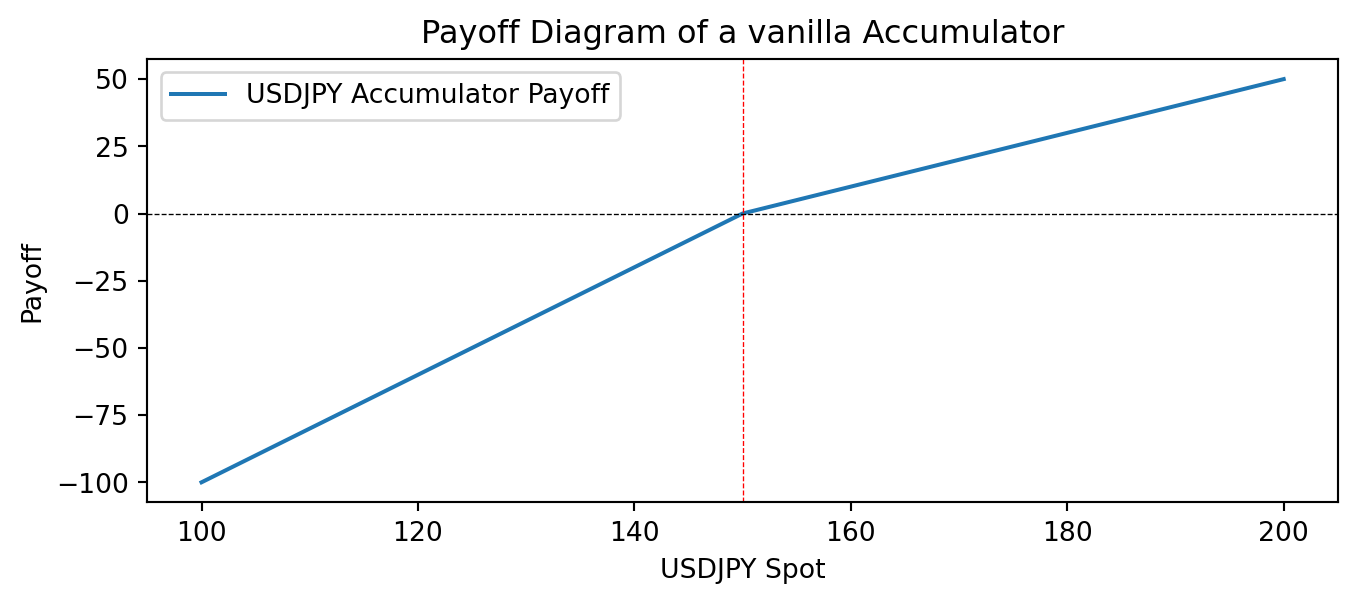

Replicating a vanilla Accumulator:

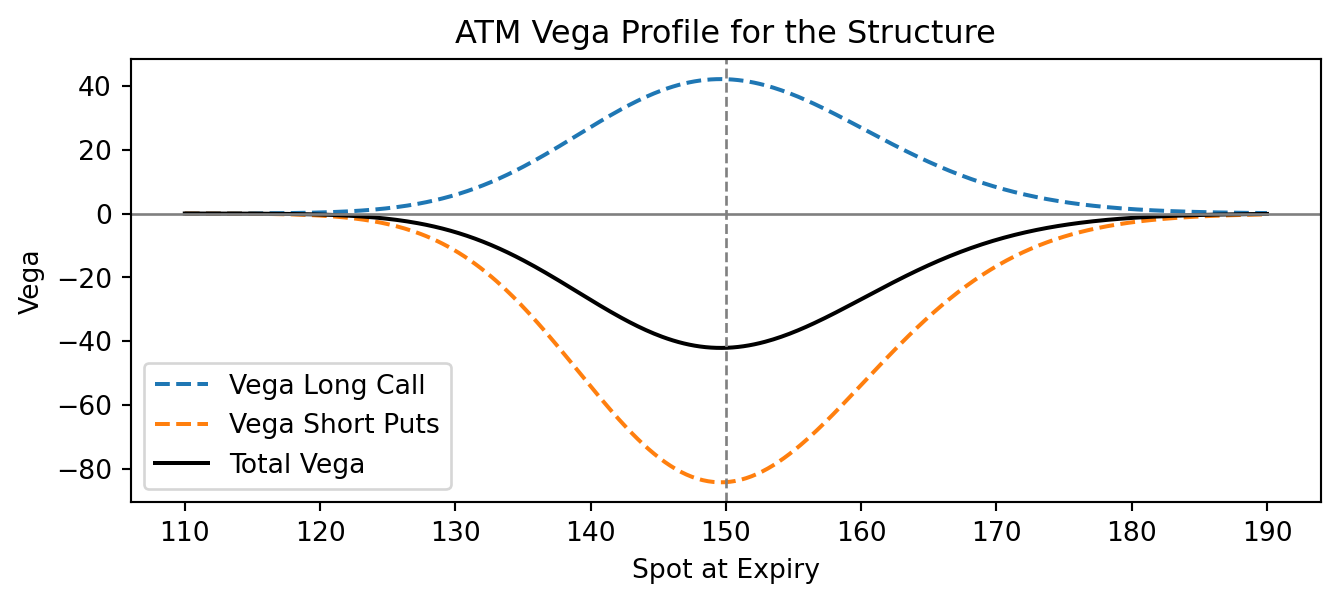

It should not be difficult to follow that we can replicate this structure with Long one Call plus Short two Puts. For a quick illustration, we take USDJPY and let Strike be 150.

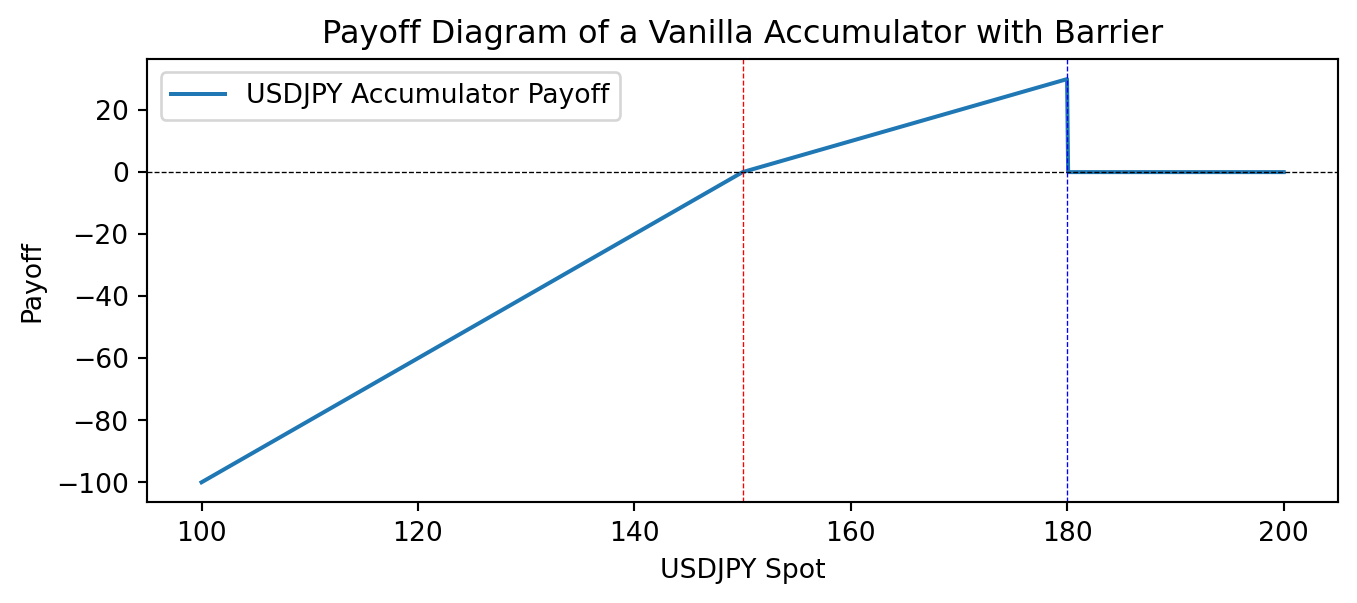

We can also add a Barrier to the structure, e.g., Knock-Out when Spot reaches 180

Risk Profile:

The trade idea is that investor believes the underlying is traded between a certain price range between the Strike and Knock-Out Barrier; while the seller believes the underlying will fall below the Strike – essentially it’s a zero-sum bet on whether Spot will be volatile between buyers and sellers

If Strike < Spot < Barrier, buying ONCE at discounted price X

If Spot < Strike, buying TWICE at discounted price X

If Spot > Barrier, structure terminates

Buying as an obligation - note that the investor must buy the underlying at the Strike and the issuer must sell shares at the Strike during that period of time

The big downside risk for the investor is enhanced losses when market goes again the position - when the share prices fall, the losses are unlimited for the duration of the contract time and can’t easily get out - the reason why market participants joke it as “a-kill-you-later”!

The upside from Spot is limited by the knock-out feature with an upside barrier.

For the Vega profile, we assume a Strike of 150, Time to Expiry is 6mth, 1% interest rate and 20% implied vol

2. Accrual and Accrual Range in FX:

Accrual Option inherits the basic structure of a vanilla Accumulator, and it’s more common in FX

Product nature is the same: Notional is not static and builds up (accrues) over time.

Accrual being a product of FX derivatives, it follows a Fixing schedule, and the Rate of Accrual depends on where the Spot fixes compared to the Accrual Barriers

European Accrual: if Spot goes through the Barrier, accrual stops with what has been accrued, but if Spot comes back inside the Barrier, accrual restarts

American Keep: if Spot ever goes through the Barrier, accrual stops with what has been accrued.

Range Accrual: one of the most common format of the accrual; Range Accrual pays out an accrued notional at expiry.

Example: European Double-Barrier Range Accrual

--------------------------------------------

CCY Pair: USD/JPY

Tenor: 1yr

Spot: 155.50

Notional: 1m USD

Fixing: 250 daily

Fixing Source: to be confirmed

Down European Barrier: 150.00

Up European Barrier: 165.00

--------------------------------------------

The notional, 1m USD in our case, is not invested in the position as a lump sum payment when the structure becomes alive. Instead, the notional is split equally between the fixings. Since 1yr tenor has 250 fixing excluding the holidays, we get 4k USD per fixing added onto the cash payout at maturity if Spot fixes between barriers.

We can see that the only difference is that we have two barriers now, one up and down.

For every fixing in the schedule, if Spot fixes between the two barriers,

However, if Spot goes outside the range, either it fixes outside the range or between two fixings, accrual stops, but for a European version, if Spot later comes back to the range, accrual will restart.

Risk Analysis: Range Accrual

We can see that by comparison, Range Accrual requires a more precise view on the Spot’s movement, both top and down, in a specific tenor

The European version reduces the fixing risk by allowing the structure to be re-activated if Spot fixes back

Now let’s consider a very short-dated Range Accrual that fixes (lasts) only once.

For this short-dated Range Accrual with only 1 fixing at expiry

This is essentially a Digital Range: the European Range Accrual becomes a European Digital Range, which pays out the full notional if Spot is within the Range at expiry.

Therefore, European Range Accrual can be perfectly replicated by a Strip of European Digital Ranges, expiring at each Fixing within the range accrual, each with their cash payout, Notional×(1/N) , late-delivered to the delivery date of the Range Accrual.

Vega Risk:

For European Digital, the Vega profile from a long European Digital Range is Long Vega in the wings (want Spot to move back into the range) and Short Vega between the Barriers (don’t want Spot to move).

This same profiles also applies to European Range Accruals:

If Spot is between the range barriers, more payout will be accrued if Spot just stops moving – hence Short Vega

If Spot is outside the range barriers, Spot needs to move into the range again to start accruing – hence Long Vega