Creation & Redemption Mechanism in International ETF Trading

Overview

ETFs are essentially funds that trade like stocks. For US equity ETF market, there are some classic domestic names such as SPY and QQQ. More recently, investors are looking at the US-exchange-listed ETFs that focus on international market such as the EWU for UK stocks, DXJ for Japan, or EEM for emerging markets.

Two main challenges for trading international names:

Timing when the local market is closed

FX Exposure

First, the lagging timing challenge. When the local market for the international name is closed, pricing its fair value will be more complicated. Consider that German DAX trading from 9 to 5:30 CET, which is 3AM to 11:30AM EST. At 11:31 AM EST, if a client makes a decision to buy ETF, the order will not be executed until the market on close in Germany on the next German trading day, which is 3AM EST the next US day.

Second, the FX exposure. A US-listed International ETF has inherent FX exposure, which means even if the prices of all the underlying components don’t move, the FX rate between the purchase and execution time will cause the USD price of the ETF to fluctuate

E.g., if one long an US-listed Japanese ETF, he or she is inherently long JPY exposure against USD. If USD strengthens against JPY (USDJPY goes up), the ETF will lose value in USD terms

For a dollar investor, the risk profile for long an-unhedged international ETF is:

Upside: long Japanese stocks and long JPY at the same time

Downside: extra FX Risk compared to a currency-hedged position

For now, the long JPY exposure seems bullish as BOJ YCC policy is still targeting at USDJPY at 150 level to help strength yen, or risk-off sentiment as no interest rate cuts is prominent right now

For CCY like HKD, because USDHKD is pegged and thus it’s less volatile.

If the dollar investor has a clear investment goal, a currency-hedged position should be the core holding for international exposure

For EEM, it’s more complicated due to multiple EM currencies

But the lag of time can also create a boon: not trading in-line with the underlying basket makes the international ETF a “price discovery vehicle” – it estimates where the underlying basket will be trading when it begins trading at the local market open. [Japan and Germany equity index] This lack of arbitrage opportunities due to the closed local markets leads to the observation that these ETFs will usually trade at a premium or discount to their IIV.

Making Market for an international US ETF

The process of making markets (providing liquidity) in an international ETF in which the underlying is not trading at the same time as the ETF is very different from doing so for the domestic version.

- If the customer buys a large block of the Japanese ETF, the liquidity provider (AP) will then sell the ETF to the customer. At this point, the LP has two options: either (1) purchasing shares of the ETF back in the markets at a cheaper price, or (2) purchasing some pre-designated hedge for its position. In a situation where the ETF and the basket trade simultaneously, the LP would buy the basket (also called Long Creation Unit) to perfectly hedge the Short ETF position.

- In our case, because the basket is not trading simultaneously with the ETF, the LP needs to rely on the eNAV and the correlated hedge to reduce its exposure. Even with a great hedge, however, the process of unwinding the position is not as simple as creating the ETF at the next opportunity. In this example the LP has sold the ETF to the customer and put on a position that correlates to the ETF and trades during the same trading hours as the ETF.

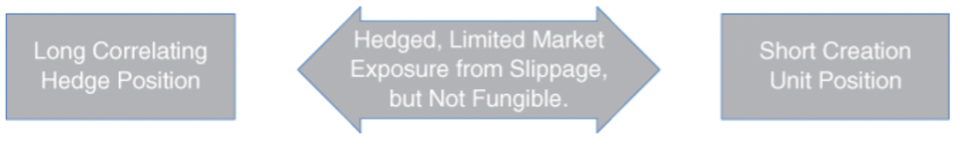

- Unlike in the domestic position, this position CANNOT be flattened via the C/R mechanism. If the LP decided to do a creation of the ETF to try to unwind its Short position, it would just end up with a Short position in the Creation Unit, as can be seen in.

- Since the C/R mechanisms are based on the in-kind transfer of one asset for a basket of other assets, they represent the same exposures. Since the Correlating Hedge is not the creation basket, the position is not flattened via the C/R mechanism. - C/R is usually utilized to gain access or switch positions between the ETF and the underlying basket if that is a more advantageous position. - However, the correlated hedge position will still remain on the books until the market-maker trades out of it.

To summarize the process:

For a domestic name:

- Client Buy → AP Sell ETF → need to Long the basket for hedging → for long either (1) Long the ETF shares back in the market aiming at a cheaper price; or (2) Long the basket (i.e., Long Creation Unit). Either of these two options can perfectly or closely hedge the Short ETF position

For an international name:

- Client Buy → AP Sell ETF → need to Long the basket for hedging → now AP needs to use the “estimated” NAV (eNAV) to find a hedge which correlates to that ETF in the US market (“pairs-trading”). But that’s not the end of the story. Unlike in the previous domestic case, this position CANNOT be easily flattened via the C/R Mechanism to get the CU. In other words, if AP decides to do a Creation of the ETF shares to unwind the Short ETF, it would just end up with a Short in the CU! [Automated Correlation Hedge]