| Date | Event |

|---|---|

| 08-09 Fri | PBOC's quarterly report sent two messages: (1) plan to narrow Rate Corridor; (2) warningss over bond market bubble |

| 08-09 Fri | Regulators ask state-run banks to note down names of CGB buyers to curb the onging unprecedented bond rally |

| 08-08 Thu | Some rural banks in affluent provinces were told to suspend trading sovereign notes after four rural commercial banks in Jiangsu were probed by the NAFMII over manipulating prices in the secondary market |

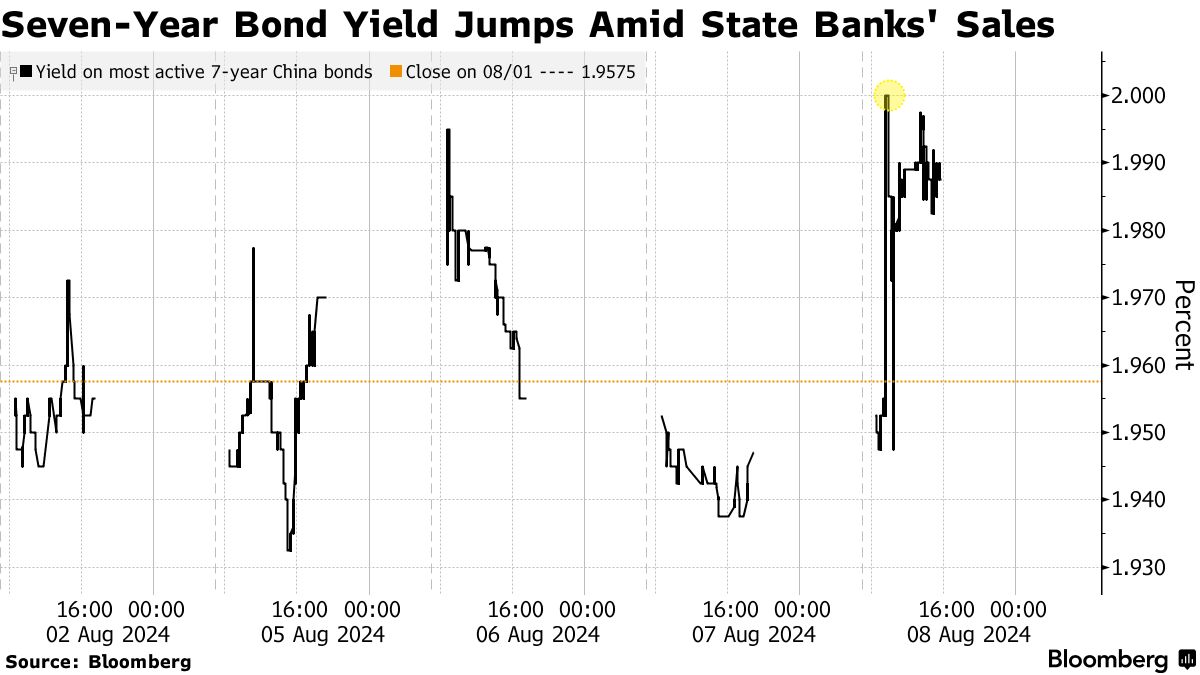

| 08-07 Wed | State-banks unexpectedly began selling 7yr bonds to pull up Yields, undermining a popular sweet spot |

| 08-07 Wed | Regulators asked some money managers to report the duration of any new bond bund products, and significantly slowed down approval process for new bond funds in the latest effort to curb risks |

| 08-05 Tue | State-banks sold 10yr CGB in batches of 100 million CNY (14 million USD); the selling focused on sovereign notes issued in May and are one of the most actively traded in the rates market. 10yr Yield erased earlier losses to trade as high as 2.15%; earlier in the day, the rate sank below the closely watched 2.1% for the first time in history. Lenders also sold 30yr special government bonds in large sizes |

| 08-04 Mon | JPMAM noted 2s10s gap heightens risk of PBOC intervention |

| 08-01 Thu | Traders now turned to 7yr CGB, which dipped below 2% for the first time in history as speculators take advantage of bets on further rate cuts with a lower threat of official pushback at a record rally |

| 07-30 Tue | Chinese policymakers pledged to make boosting consumer spending a greater policy focus, as weak domestic demand threatens the nation’s annual growth target despite an export boom |

| 07-30 Tue | Chinese regional banks become the most aggressive buyers of CGBs over the past year to make up for profits on the lending business due to weaker loan demand, which clashes with regulators seeking to limit risks after an unprecedented bond rally this year, citing precedent of the collapse of Silicon Valley Bank, which had piled into UST before rates rose. |

![]() China

China

CGBs: the JGBs for 2024

The Chinese CGBs, a $4.3 trillion sovereign debt market, have been among the best performers in the world this year as the central bank PBOC lowers interest rates to revive growth in an economy battered by a housing slump and weak consumer demand. Data from Bloomberg reported that the Bloomberg China Aggregate Total Return Index has risen 4.6% this year, compared with a 1.06% gain in a similar US gauge.

Mired in a property slump and beset by deflation, China’s economy needs a low interest-rate environment to stimulate growth. Bonds have soared after the central bank cut interest rates to revive growth in an economy battered by a housing slump and weak consumer demand.

This bond rally is raising concerns from regulators that banks and investment funds are exposing themselves to excessive risk if the market turns. Demand for bonds has been so strong that investors snapped up government debt at record low yields at the latest auction.

A battle between the authorities and government bond buyers has intensified during the first week of August. The central bank refrained from injecting short-term liquidity for the first time since 2020, yet investors still drove yields to record lows at an auction.

- 10yr CGB Yield touches a fresh low of 2.2% on Aug 7 during the record CGB rally

- In a tactical manuver to avoid regulatory pushbacks, traders now redirect to 7yr from 10yr benchmark

- PBOC: the central bank of China, led by Governor Pan

- State-Owned Banks: Big Five as Bank of China, Bank of Communications, ABC, CCB, and ICBC - designated market makers for PBOC’s intervention

- Regional Banks: city and rural commercial banks in different provinces, a vast and opaque network, e.g., of more than 1600 rural lenders, just 13 of them publicly listed - substantial holders of CGBs

- NAFMII: regulator for the regional banks

Chinese sovereign debt, CGB, mostly in the benchmark 10yr and recently crawling into the belly 7yr