| Date | Desc |

|---|---|

| Aug 09 Friday | SPX finishes flat; 2yr Yield finishes higher |

| Aug 08 Thursday | SPX rises 2.3%, biggest gain since 2022 |

| Aug 07 Wednesday | SPX closes -0.77% after an intraday high of 1.7% |

| Aug 06 Tuesday | SPX gains 1%, VIX plunges most since 2010 |

| Aug 05 Monday | SPX falls 3%, VIX spikes from 23 to 65 |

![]() US

US

Equities

US Market on Close:

Thu, Aug 22

Ahead of the Jackson Hole speech, as the market expects less aggressive rate cuts and the robustness of the US economy, all major equity benchmark fell:

On market close in NY, SPX fell 0.9%, NDX down 1.7%, and DJIA decrease 0.4%. For mega-caps, Magnificent 7 Total Return Index suffered a 2.4% loss; for small-caps, RUT fell 0.9%.

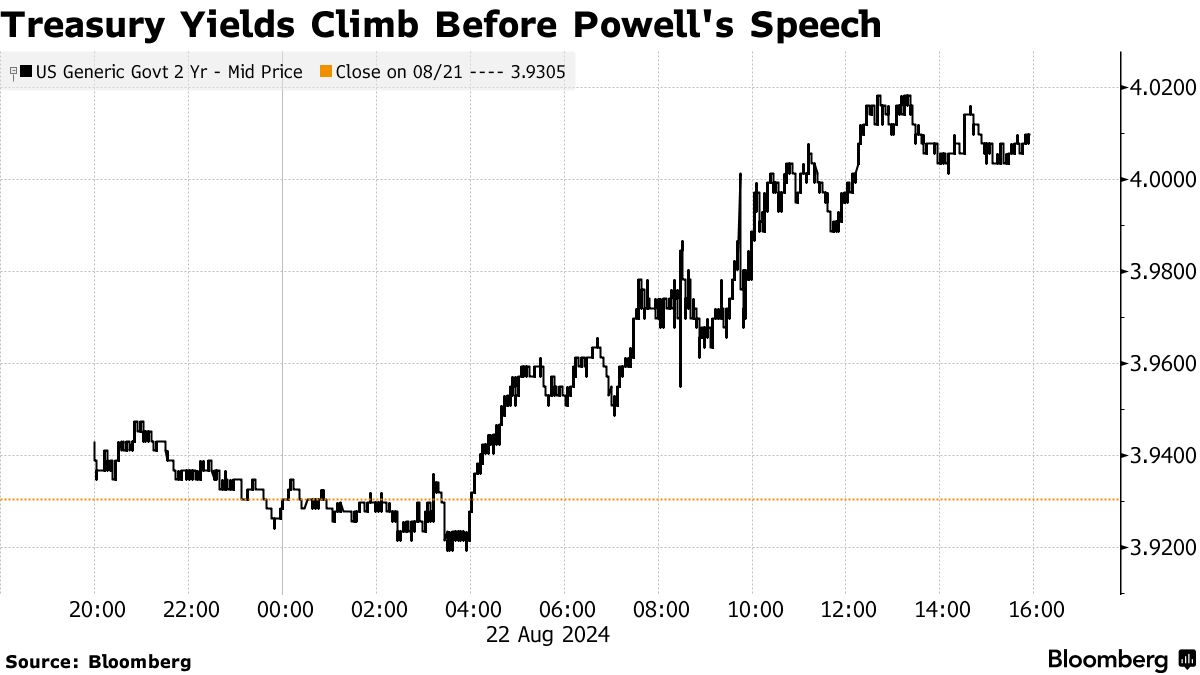

For FICC, dollar strengthened with DXY rose 0.4%, largest gain in over a month. UST fluctuated, with the move led by shorter maturities; 2yr UST Yield climbed around 8bps finishing around 4.01; 10yr Yield rose 6bps to 3.86%. WIT rose 1.4% to $72.93 a barrel. Gold Spot fell 1.2% to $2,483.12 an ounce.

The “slower to lower” expectation that Powell will very likely signal rate cuts but only on 25bps during tomorrow’s Jackson Hole speech has prompted a retreat from mega-cap stocks, which emerged as a safety trade due to their steady profits and balance sheets during the tightening cycle. NVDA lost 3.7% to 123.74 at 4PM.

Single-Stock Highlights:

Thu Aug 22

Uber (UBER) shares fell as much as 4.4% to $70.05 during late hours after announcement that it plans to start offering self-driving Cruise LLC cars on its platform next year. Previously GE’s Cruise was revoked license after its autonomous vehicle struck and hospitalized a pedestrian.

Wed Aug 21

Disney (DIS) named the former CEO of Morgan Stanley to lead the search committee for a successor to CEO Bob Iger. Australian-American Gorman was the CEO of MS in from 2010 to 2023. DIS finished 1.1% up on Wednesday during the regular session and was down 0.2% after hours.

Zoom (ZM) raised annual revenue forecast, giving a profit-per-share of $1.3 higher than the analyst projection of $1.24. The stock has dropped 16% in 2024 YTD and hit a record low earlier in August. The shares closed at $60.23 in regular hours and after closing there was about a 2% gain by 5:30 pm. In recent weeks, Zoom’s video product has been host to massive political events in the US with groups organizing fundraisings. The company launched a new conference function that can support up to 1 million attendees.

Apple (AAPL)’s head of the software marketplace App Store is leaving as part of a reorganization of the lucrative division, which previously has drawn regulatory scurrility over antitrust concerns.

Ford (F) is scaling back and re-calibrating its electrification strategy, canceling plans for a fully electric sport utility vehicle.

Walmart (WMT) raised about $3.6 billion by selling its stake in the Chinese e-commerce JD.com (JD), closing a 8-year partnership that appears to paying diminishing returns.

August Global stocks selloff:

Tue, Aug 06

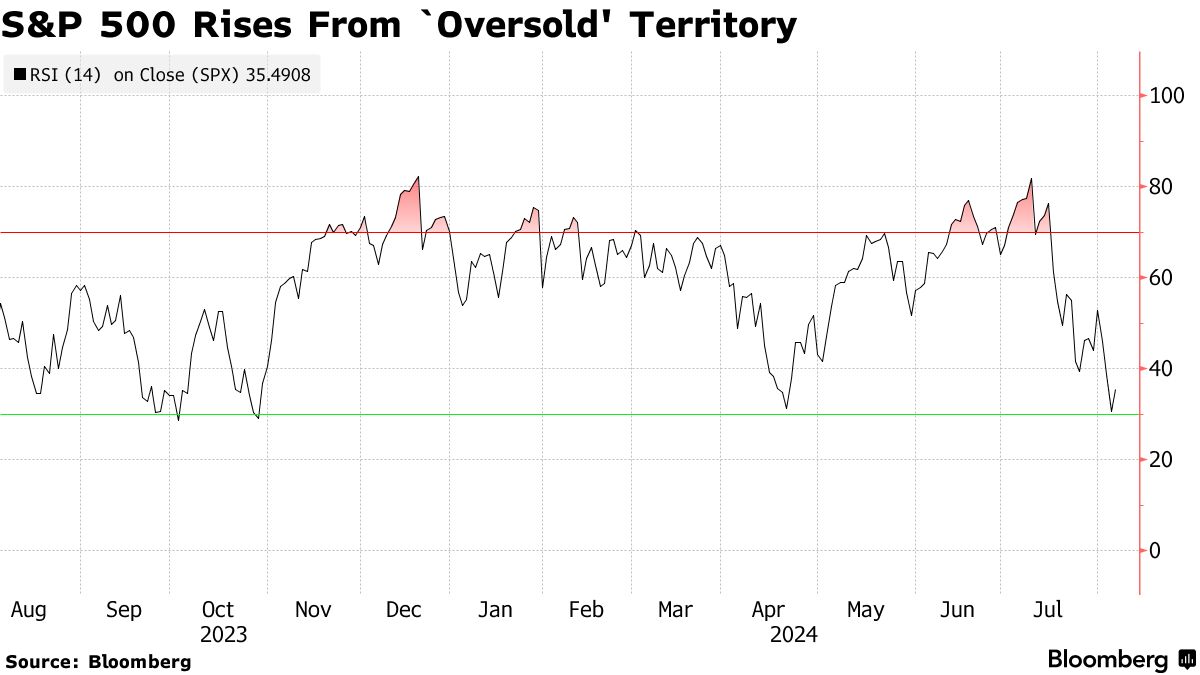

All major US benchmarks rose as investors scooped up a wave of dip buying after a hectic Monday, spurring a rebound after a roughly $6.5 trillion selloff. A semblance of calm returned to markets after the selloff sent the market to Oversold territory and due for a bounce

- Both SPX and Nasdaq 100 climbing 1% with DJIA rose 0.8% as of 4 pm NYT

- VIX saw its biggest plunge since 2010.

- Additionally MSCI World Index rose 1.1%; BLBG Magnificent 7 Total Return rose 1.2%; Russell 2000 rose 1.2%. Nvidia jumped 3.8% to lead gains in chipmakers.

Yield of 10y UST advanced 10bps to 3.89%

Macro

Thu, Aug 22

Boston and Philly’s Fed chairs state that the pace of rate cutting should be “gradual” and “methodical”, discouraging the markets bet on a 50bps cut in September.

- Boston’s Fed President Susan Collins and Philly’s Fed President Patrick Harker used similar terms in news interviews; while Kansas City President Jefferey Schmid said he wants to see more data before supporting cuts. Bets on Fed Fund Futures currently show 75 or 100 bps by end of 2024.

US mortgage rates drop to a new low for 2024 as buyers await Fed cuts. Th average rate for a 30yr, fixed loan was 6.46%, down from 6.49%, Freddie Mac reported this Thursday.

In July 2024 the sales of previously owned US homes increased for the 1st time in 5 months, yet the sales pace was the weakest for any July since 2010, showing the high prices are still preventing many Americans from closing deals.

The median monthly payment was $2,587 in Aug 2024, down 0.1% from a year earlier. While that’s just a tiny drop, it marks the first annual decline since 2020

Wed, Aug 21

September rate cut outlook: Latest FOMC Minutes and Payroll Revisions released on Wed Aug 21 see as Fed rate cut in Sep as “Done Deal”.

First, the Fed minutes from the July 31 meeting further assured that market that policymakers are closely watching the rise in employment rate.

The discussion published indicates that the committee has begun to focus on the risk regarding the labor market. To reiterate, in July we had a much weaker NFP number and jobless rate rose to 4.3%, the highest since Oct 2021. ”

“If the data continued to come in about as expected, it would likely be appropriate to ease policy at the next meeting.”

What’s the most interesting comment is that some committee members had indeed considered cutting rates for 25bp back in July.

“A majority of participants remarked that the risks to the employment goal had increased, and many participants noted that the risks to the inflation goal had decreased,” the minutes said.

As reported by Bloomberg, in a hindsight some voices including GS Chief Economist Jan Hatzius, former Fed Vice Chair Alan Blinder, and former NY Fed President William Dudley had argued the case for a July rate cut due to the softening labor market.

The rate cut in September seems to be a done deal, but the markets are still disagreeing over the magnitude, with some argue for a 50bps move to assure a soft landing. Futures market are pricing in about 100 bps cut by the end of 2024.

Second, the payroll revisions state job growth was likely overstated by 818,000, reiterating the idea that the labor market has been cooling more and for longer than previously thought.

- The numbers were highly anticipated after the last employment report showed that payroll growth unexpectedly slowed significantly, driving the markets to bet on rate cuts in September – all of which could been upended if the revisions showed any strength in the labor market, (luckily), they did not.

When the data was finally released around 10:30, it showed payrolls will be revised down by 818,000 for the 12 months through March, the steepest markdown to the job market since 2009.

Shortly after the release, equities jumped and bonds gained.

SPX touched 5630 from 5610, down to 5623 at 4PM NYT, a 0.42% rise. Other major stocks index also gained, NDX advanced 0.5% and DJIA rose 0.1%. Dollar Index DXY was little changed.

For bonds and commodities, 10yr UST gained, with yield declined 1bp to 3.79%. In commodities, WTI fell 1.7% to 71.94 while Gold Spot was little changed.

Fri, Aug 09

Fed’s Bowman sees upside inflation risk and signals caution on cuts: Fed Governor Michelle Bowman said she still sees upside risks for inflation and continued strength in the labor market, signaling she may not be ready to suppose a rate cut in Sep.

“The progress in lowering inflation during May and June is a welcome development, but inflation is still uncomfortably above the committee’s 2% goal. I will remain cautious in my approach to considering adjustments to the current stance of policy.”

— Bowman in a speech to the Kansas Bankers Association in Colorado Springs, referring to the Fed’s rate setting panel.

Thu, Aug 08

Seasonality Adjustment gives a welcome reversal for the US job market: the weekly initial jobless claims released this Thursday after a seasonal adjustment fell more than expected for the week ended Aug 3, the largest drop in about 11 months, a welcome reversal after last week’s NFP data.

Economists commented that it most likely reflects a fading in the impact from temporary motor vehicle plant shutdowns and Hurricane Beryl.

This adjusted number eased the tension about the US job market as the severity of the worse July payroll was partly an outsized blip due to the record number of people unable to work due to the bad weather slammed into Texas during the employment report survey week. It was reported that some 2.7 million homes and businesses in the Houston area were without power for days. And it was estimated that 436,000 nonfarm workers and 461,000 agriculture workers were affected.

Following the release, US stocks gained, UST yields rose back above 4%, USD strengthened.

After the release, the probability of a 0.5% cut in Sep by Fed reduced from 70% to 58%

Other US News Highlights

Aug 19-25

Aug 21

- The Pasadena-headquartered fixed income manager Western Asset Management is facing probe by the US Attorney’s Office in Manhattan and SEC, which is investigating whether executives favored certain client accounts by allocating more winning trades. Western Asset’s co-CIO, Ken Leech, was taking an immediate leave of absence after receiving a Wells notice from SEC. Leech manages some of the largest bond strategies in the US. As of June 30, 2024, Western Asset has $381.1 billion AUM in fixed income.

Aug 05-11

Aug 09

- Susan Wojcicki, former CEO of YouTube from 2014 to 2023, passed away at 56 due to lung cancer. Wojcicki was among Google’s longest-serving employees and one of the highest-profile female executives in Silicon Valley.

Aug 08

- Eli Lilly & Co is narrowing the gap with the European rival Novo Nordisk A/S in the race to dominate the obesity market as it expands its supplies of weight-loss drugs; shares soared as much as 10% as its blockbuster w-l drug zepbound outsells expectation.

- Apple is planning a new version of the Mac Mini with AI-focused M4 chip set to be its smallest computer ever

Aug 07

Aug 06

- Kamala Harris chose Minnesota Gov. Tim Walz as her running mate.

- Disney (DIS) is raising its streaming services as much as 25% in October.

- Uber (UBER) and Caterpillar(CAT) reported better-than-expected earnings in the 2nd quarter.